In the ocean of blockchain topics in the web space, we frequently encounter blockchain-idealists’ mantras: popular ones are often associated with disintermediation (elimination of middlemen) and peer-to-peer system. It casts a radical notion that a blockchain-base distributed system can eliminate rent-seeking middlemen and, as a result, deter, or even eliminate an abuse of the system by monopolist and oligarchs.

However, the reality of blockchain as of today is far from, is even contrary to, such radical notions. The gap between the popular blockchain-idealists’ mantras and reality has caused confusions about blockchain.

The gap causes confusion about blockchain. Despite the gap, their beautiful mantras continue to echo and have strong influence in shaping our collective perception about and our collective behaviour toward blockchain.

Are those mantras really viable ideas? Are they hypnotising us with those deceptive mantras? Or, are we in the middle of a long journey to realise such a radical revolution in the way we organize transactions?

This series explores causes for the confusion. As a recap, the earlier chapters (blogs) contemplated two suspects behind the confusion:

1) Linguistic ambiguity:

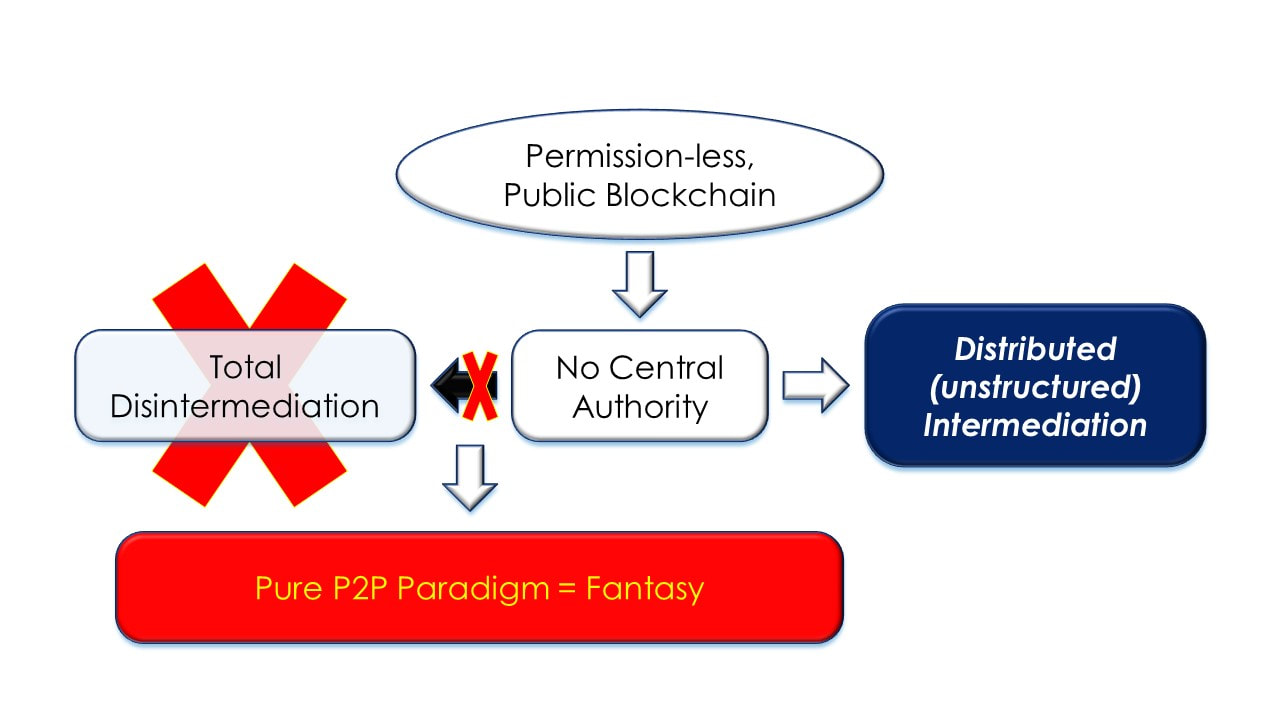

Trilemma and concentration curse are inherent in “permission-less, public blockchain” and confront some of the premises of the pure peer-to-peer paradigm Satoshi Nakamoto contemplated. Disintermediation is far from the reality of pure peer-to-peer paradigm as of today.

Now, in order to continue the search for other suspects that account for the confusion, the chapter 3 (this third blog) of this series shifts our focus into a new territory, “myth-conception” (myth arising from misconceptions) existing in the blockchain space. The following list gives us some examples of blockchain myth-conceptions:

1) Disintermediation Myth-Conception:

2) “Autonomous Self-Regulating Governance” Myth-Conceptions:

Certainly, de-mythification of these myth-conceptions would reduce fundamentalistic mantras from myths to delusions. Nevertheless, a hope shall remain: as technology advances, some myth-conceptions might evolve to become a part of reality. This is a question that no one can answer today: only time will tell.

This blog as the chapter 3 of this series questions the first item in the list above, a myth-conception about one of the popularised notions, disintermediation. First, we will explore mechanisms behind the reality of “permission-less, public blockchain” surrounding intermediations. And later, we will explore a contrary alternative view that questions the notion of “total disintermediation” in the context of a peer-to-peer paradigm.

However, the reality of blockchain as of today is far from, is even contrary to, such radical notions. The gap between the popular blockchain-idealists’ mantras and reality has caused confusions about blockchain.

The gap causes confusion about blockchain. Despite the gap, their beautiful mantras continue to echo and have strong influence in shaping our collective perception about and our collective behaviour toward blockchain.

Are those mantras really viable ideas? Are they hypnotising us with those deceptive mantras? Or, are we in the middle of a long journey to realise such a radical revolution in the way we organize transactions?

This series explores causes for the confusion. As a recap, the earlier chapters (blogs) contemplated two suspects behind the confusion:

1) Linguistic ambiguity:

- The term “blockchain” is a blanket word too general to describe peer-to-peer specific blockchain applications.

- Only “permission-less, public blockchain” is relevant to a peer-to-peer paradigm.

- Other blockchains—"permissioned, private blockchain” and “permissioned, federated/consortium blockchain”—only reinforce intermediation.

Trilemma and concentration curse are inherent in “permission-less, public blockchain” and confront some of the premises of the pure peer-to-peer paradigm Satoshi Nakamoto contemplated. Disintermediation is far from the reality of pure peer-to-peer paradigm as of today.

Now, in order to continue the search for other suspects that account for the confusion, the chapter 3 (this third blog) of this series shifts our focus into a new territory, “myth-conception” (myth arising from misconceptions) existing in the blockchain space. The following list gives us some examples of blockchain myth-conceptions:

1) Disintermediation Myth-Conception:

2) “Autonomous Self-Regulating Governance” Myth-Conceptions:

- Smart Contract Myth-Conception;

- Immutability Myth-Conception;

- Byzantine Fault Tolerant Myth-conception.

Certainly, de-mythification of these myth-conceptions would reduce fundamentalistic mantras from myths to delusions. Nevertheless, a hope shall remain: as technology advances, some myth-conceptions might evolve to become a part of reality. This is a question that no one can answer today: only time will tell.

This blog as the chapter 3 of this series questions the first item in the list above, a myth-conception about one of the popularised notions, disintermediation. First, we will explore mechanisms behind the reality of “permission-less, public blockchain” surrounding intermediations. And later, we will explore a contrary alternative view that questions the notion of “total disintermediation” in the context of a peer-to-peer paradigm.

Concentration Curse

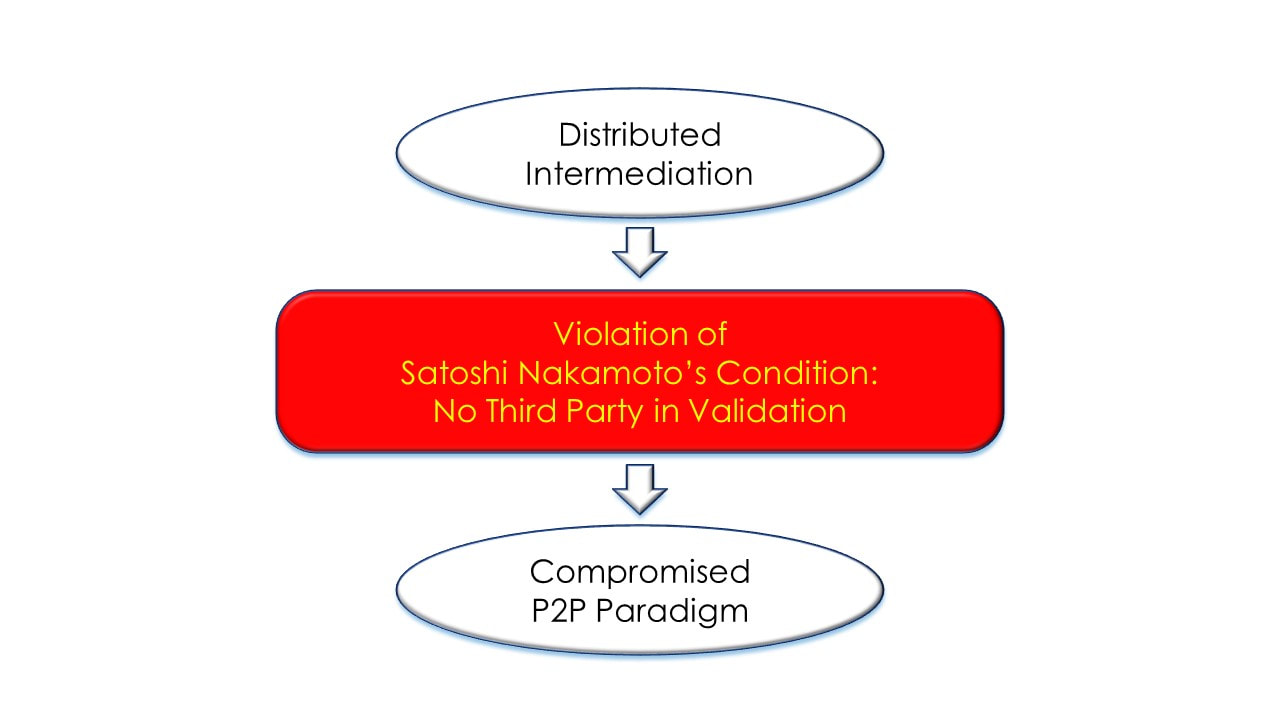

As discussed in the previous chapter, Satoshi Nakamoto contemplated a peer-to-peer paradigm that can operate under a certain set of conditions. One of these conditions is the perfect absence of any third party in the validation process: “[T]he main benefits [of digital signatures] are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.”

This is a notion of disintermediation and a “no-friction” transaction paradigm. And, it further casts a notion of an autonomous self-governing system.

On the contrary, the reality of blockchain as we know it today contends against such notion of a “no-friction” autonomous self-governing system. What prevents it from happening? What hindrances are there?

First, let us contemplate the mechanism of such hindrances.

Here is an inauspicious fact from Bitcoin case, a popular application of “permission-less, public blockchain” applications.

This is a notion of disintermediation and a “no-friction” transaction paradigm. And, it further casts a notion of an autonomous self-governing system.

On the contrary, the reality of blockchain as we know it today contends against such notion of a “no-friction” autonomous self-governing system. What prevents it from happening? What hindrances are there?

First, let us contemplate the mechanism of such hindrances.

Here is an inauspicious fact from Bitcoin case, a popular application of “permission-less, public blockchain” applications.

About 70% of Bitcoin mining (measured in hashrate) is dominated by only top FIVE miners.

[as of January 2018: (BTC.com, ND; Kasireddy, 2017)]

[as of January 2018: (BTC.com, ND; Kasireddy, 2017)]

What does the fact tell us?

It gives us a key to our question: concentration. This tells us a quite high concentration in the mining sector of Bitcoin space. High concentration in intermediaries is paradoxical to the notion of “permission-less, public blockchain,” which promotes a notion of a democratic system which deters, or even eliminates an abuse of the system by monopolist and oligarchs.

In a general frame of mind, a concentration can be shaped by high entry barriers. An entry barrier can be built by some sort of asymmetry—economic, technical, or political.

In a way, this fact should make us question whether Satoshi Nakamoto and his followers, in shaping their idea of peer-to-peer system, appropriately contemplated such potential asymmetry and its consequence, entry barrier, in the eco-system; or whether it was a part of their intended, but hidden plan to build up the Distributed Kingdoms of Intermediaries (or Distributed Intermediaries of Blockchain) for their own benefit.

To understand what accounts for the concentration in the space of “permission-less, public blockchain,” we focus on the cases of the earlier two generations of consensus protocols, Proof of Work (PoW) and Proof of Stake (PoS). These earlier generations of consensus protocol raised issues that need to be resolved in the future. Thus, their cases help us paint a perspective of “concentration curse” in the current state of “permission-less, public blockchain.”

It gives us a key to our question: concentration. This tells us a quite high concentration in the mining sector of Bitcoin space. High concentration in intermediaries is paradoxical to the notion of “permission-less, public blockchain,” which promotes a notion of a democratic system which deters, or even eliminates an abuse of the system by monopolist and oligarchs.

In a general frame of mind, a concentration can be shaped by high entry barriers. An entry barrier can be built by some sort of asymmetry—economic, technical, or political.

In a way, this fact should make us question whether Satoshi Nakamoto and his followers, in shaping their idea of peer-to-peer system, appropriately contemplated such potential asymmetry and its consequence, entry barrier, in the eco-system; or whether it was a part of their intended, but hidden plan to build up the Distributed Kingdoms of Intermediaries (or Distributed Intermediaries of Blockchain) for their own benefit.

To understand what accounts for the concentration in the space of “permission-less, public blockchain,” we focus on the cases of the earlier two generations of consensus protocols, Proof of Work (PoW) and Proof of Stake (PoS). These earlier generations of consensus protocol raised issues that need to be resolved in the future. Thus, their cases help us paint a perspective of “concentration curse” in the current state of “permission-less, public blockchain.”

Case for Bitcoin’s Proof of Work (PoW):

For the case of Bitcoin’s PoW, I would like to share the following resources, analyses made by a world prominent Bitcoin analyst, Digiconomist. (Digiconomist, 2014; 2016)

With general basic economic frameworks—“economies of scale” and “demand-supply market mechanism”--Digiconomist illustrates the notion of “Concentration Curse” for intermediaries in Bitcoin’s space. (Digiconomist does not use the term, “concentration curse,” but reveals it.)

- Understanding Economies of Scale (Digiconomist, 2014): https://digiconomist.net/understanding_economies_of_scale/

- How Limited Block Size May Centralize The Use Of Bitcoin (Digiconomist, 2016): https://digiconomist.net/how-limited-block-size-may-centralize-the-use-of-bitcoin

With general basic economic frameworks—“economies of scale” and “demand-supply market mechanism”--Digiconomist illustrates the notion of “Concentration Curse” for intermediaries in Bitcoin’s space. (Digiconomist does not use the term, “concentration curse,” but reveals it.)

Concentration by “Economies of scale”:

Digiconomist reveals that as of today, for Bitcoin’s PoW, “concentration curse” is an inevitable, natural consequence of “economies of scale.” Economies of scale is a notion that “per-unit cost efficiency” increases as the production scales up, as a desirable consequence of spreading out the fixed cost over a larger number of output.

1. Concentration among large scale miners:

Economies of scale works in the Bitcoin miner’s space as well. It triggers a competitive race for a better profit margin [= (Income – Cost) /Income)] or just a better profit. This competition also comes with a pursuit for a better efficient hardware computing power, which requires a substantial initial investment. A higher initial cost encourages miners to scale up the production in order to spread out the initial investment cost for a better per-output cost efficiency. In reality, the economic and technical efficiency of hardware computing power is different from one miner to another. A miner with better economic and technical efficiencies, would have a competitive advantage. This would reinforce a concentration in mining among a few highly efficient miners.

Digiconomist explains:

Digiconomist explains:

“All participants in a PoW mining network are competing for the same block rewards, and these rewards are on average equal to the proportion of network hashrate owned. Profitability is therefore mainly dependent on efficiency, and economies of scale dictate efficiency (profitability) must be greater if the scale of the operation is bigger.”

“PoW mining is not just an energy-wasting process, it is also an extremely competitive process by nature. Participants are constantly tempted to improve their mining efficiency, which forces other to join in an arms race or drop out. It leads to a situation where profit maximization is not just desirable, but also a necessity. As increasing scale means more costs benefits, hashrate will cluster together.

(Digiconomist, 2014)

On the top of that, a reduction in the mining fee, block reward, would squeeze their profit margin per transaction, with other conditions constant. This would further advantage larger scale efficient miners. On the other hands, as mining fee declines, smaller scale miners that are unable to scale up their production would end up facing only a squeeze in their profit margin. This would diminish the economic incentive for smaller scale miners to continue mining. As a result, they can be forced out of the ecosystem. As a consequence, this further reinforces the tendency of concentration among large scale efficient miners.

In a way, economies of scale build up a high entry barrier.

In a way, economies of scale build up a high entry barrier.

“Economies of scale thus have a centralizing effect on the network hashrate. This is further amplified by reductions in block reward, as these put a bigger strain (relatively) on less efficient miners.”

2. Concentration in Transaction Platform (Exchange, Wallet):

Digiconomist, , further demonstrates that the mining sector is not alone in the concentration curse, transaction platforms—such as exchange and wallet—are also spelled by “concentration curse” driven by “economies of scale.” The below is a summary of Digiconomist’s analysis.

In order to understand how “economies of scale” works for transaction platforms, we need to understand the cost structure determined by two modes of transactions: “On-Chain” and “Off Chain.”

A transaction among users within a platform, e.g. exchange or wallet, only changes the record among users within its ledger system: such transactions would not trigger any transfer of crypto-currency out of the platform’s system. Such intra-intermediary transaction, a.k.a. “Off-Chain” transaction, would not incur any cost to the intermediary, except book-keeping cost, which should be negligible per transaction. Therefore, the cost to the intermediary is near ZERO.

A transaction between users across different intermediaries, a.k.a. “On-Chain” transactions, requires a transfer of crypto-currency between intermediaries and incurs transfer-cost to them.

In brief, the difference in cost for an intermediary between these two modes of transactions—“Off Chain” and “On Chain”—plays a key role in leveraging “economies of scale.”

An intermediary can, if it wishes, charge both “Off-Chain” and “On-Chain” transactions and spread the cost of “On-Chain” over near-zero-cost “Off-Chain” transactions. Such cases translate into: the more “Off-Chain” transactions, the better profit margin. Thus, a platform with a larger number of users, say a larger scale intermediary, would gain a better cost efficiency than smaller scale ones.

Overall, these two cases in the Bitcoin eco-system illustrate concentrations among a limited number of large scale players—miners and other intermediaries. This reality of PoW is a paradox to “permission-less, public blockchain,” which in principle aims at disintermediation.

In order to understand how “economies of scale” works for transaction platforms, we need to understand the cost structure determined by two modes of transactions: “On-Chain” and “Off Chain.”

A transaction among users within a platform, e.g. exchange or wallet, only changes the record among users within its ledger system: such transactions would not trigger any transfer of crypto-currency out of the platform’s system. Such intra-intermediary transaction, a.k.a. “Off-Chain” transaction, would not incur any cost to the intermediary, except book-keeping cost, which should be negligible per transaction. Therefore, the cost to the intermediary is near ZERO.

A transaction between users across different intermediaries, a.k.a. “On-Chain” transactions, requires a transfer of crypto-currency between intermediaries and incurs transfer-cost to them.

In brief, the difference in cost for an intermediary between these two modes of transactions—“Off Chain” and “On Chain”—plays a key role in leveraging “economies of scale.”

An intermediary can, if it wishes, charge both “Off-Chain” and “On-Chain” transactions and spread the cost of “On-Chain” over near-zero-cost “Off-Chain” transactions. Such cases translate into: the more “Off-Chain” transactions, the better profit margin. Thus, a platform with a larger number of users, say a larger scale intermediary, would gain a better cost efficiency than smaller scale ones.

Overall, these two cases in the Bitcoin eco-system illustrate concentrations among a limited number of large scale players—miners and other intermediaries. This reality of PoW is a paradox to “permission-less, public blockchain,” which in principle aims at disintermediation.

Concentration Curse by Supply Shortage:

Further, Digiconomist brings a more basic mechanism—the supply-demand mechanism, a very fundamental market mechanism—to explain another key driver of “concentration curse”: a supply shortage. A shortage of supply would result in an increase in price: with the given cost of production constant, a price increase would lead to an increase in profit, the very incentive for a supplier to expand its market share: this would lead to a concentration by larger scale efficient miners.

By limiting block sizes, intermediaries can now artificially manipulate the supply-demand mechanism to create a chronic scarcity, a supply shortage, and increase the price of Bitcoin. The higher the price, the higher the profit, given other conditions constant.

By limiting block sizes, intermediaries can now artificially manipulate the supply-demand mechanism to create a chronic scarcity, a supply shortage, and increase the price of Bitcoin. The higher the price, the higher the profit, given other conditions constant.

By creating scarcity in Bitcoin’s block space Core developers are now about to let the same concept get a hold on the usage of Bitcoin. Or, to put it differently, the usage of Bitcoin is at risk of becoming more controlled in the hands of intermediaries that the protocol once sought to eliminate.” (Digiconomist, 2016)

Asymmetry-driven Concentration in Participation:

Now, here we contemplate a more general suspect of concentration—asymmetry in the eco-system.

In the validation (mining) process, PoW is designed to demand a high computing power in the hardware infrastructure as well as a high level of technical knowledge in coding. These demands account for asymmetry in its ecosystem, creating two kinds of gaps: the gap in hardware capacity and the gap in coding knowledge among users.

It appears to be a mis-design in the architecture of PoW: while it claims to democratise the peer-to-peer monetary system, the validation process disadvantages ordinary stakeholders to participate in the process. In order to democratise a P2P monetary system, it would require a totally different framework that removes these demands.

In the validation (mining) process, PoW is designed to demand a high computing power in the hardware infrastructure as well as a high level of technical knowledge in coding. These demands account for asymmetry in its ecosystem, creating two kinds of gaps: the gap in hardware capacity and the gap in coding knowledge among users.

It appears to be a mis-design in the architecture of PoW: while it claims to democratise the peer-to-peer monetary system, the validation process disadvantages ordinary stakeholders to participate in the process. In order to democratise a P2P monetary system, it would require a totally different framework that removes these demands.

More Fundamental Question:

Here comes a more fundamental question.

If, in the future, a new revolutionary consensus paradigm emerges and removes computational burden in mining and resolve the trilemma issue aforementioned, is it possible to democratise the mining (validation) process?

This is an ultimate question: whether or not such paradigm can exist in reality even in the perfect absence of any economic and technical asymmetry.

Now, we should further contemplate the following issues:

Frictions can exist in such a basic territory, opportunity cost, outside technical concerns about the system. Lack of willingness to participate in the validation process among the majority might still allow a natural concentration to form in the system.

Especially, the willingness issue poses a pragmatic question. Given all the daily tasks and responsibilities individuals face in their professional and personal life, who has room and desire to engage in validation process for a massive number of transactions—if not every single transaction taking place in the world? In order to resolve this issue, we need a revolutionary game-theory base, autonomous self-regulating algorithm to eliminate human involvement out of the validation process.

If, in the future, a new revolutionary consensus paradigm emerges and removes computational burden in mining and resolve the trilemma issue aforementioned, is it possible to democratise the mining (validation) process?

This is an ultimate question: whether or not such paradigm can exist in reality even in the perfect absence of any economic and technical asymmetry.

Now, we should further contemplate the following issues:

- Ability Issue: Would ordinary individuals become code-savvy enough to be able to participate in mining? Now given the hypothetical condition given, we are not talking about a high level of coding knowledge existing today. The hypothetical condition would eliminate any barrier of technical knowledge in the eco-system. So, there should not be much of significant ability issue.

- Willingness Issue: Would all code-savvy individuals, who already possess sufficient knowledge to engage in mining, pro-actively participate in mining? This is a question about opportunity cost arising from sparing time for mining.

Frictions can exist in such a basic territory, opportunity cost, outside technical concerns about the system. Lack of willingness to participate in the validation process among the majority might still allow a natural concentration to form in the system.

Especially, the willingness issue poses a pragmatic question. Given all the daily tasks and responsibilities individuals face in their professional and personal life, who has room and desire to engage in validation process for a massive number of transactions—if not every single transaction taking place in the world? In order to resolve this issue, we need a revolutionary game-theory base, autonomous self-regulating algorithm to eliminate human involvement out of the validation process.

Implication

To sum up, let’s end this section with a Digiconomist‘s symbolic statement about PoW:

“the usage of Bitcoin is at risk of becoming more controlled in the hands of intermediaries that the protocol once sought to eliminate.” (Digiconomist, 2016)

In other words, “permission-less, public blockchain” as of today ends up shaping non-scalable, oligopolistic ecosystems, empowering new emerging middlemen through the “Concentration Curse.” This is paradoxical to the fundamentalistic view.

In this setting, viable scalable blockchain solutions existing today remain in the space of other types of blockchain—permissioned, private blockchain and permissioned, federated/consortium blockchain. Overall, the limitation of permission-less, public blockchain has empowered incumbent middleman enterprises.

Given the paradoxical reality, what are the fundamentalistic view trying to achieve with Blockchain?

A hope remains in the future development in consensus protocols. A revolutionary consensus protocol that the world has never seen yet might emerge and resolve these issues.

In this setting, viable scalable blockchain solutions existing today remain in the space of other types of blockchain—permissioned, private blockchain and permissioned, federated/consortium blockchain. Overall, the limitation of permission-less, public blockchain has empowered incumbent middleman enterprises.

Given the paradoxical reality, what are the fundamentalistic view trying to achieve with Blockchain?

A hope remains in the future development in consensus protocols. A revolutionary consensus protocol that the world has never seen yet might emerge and resolve these issues.

Disintermediation Myth:

Intermediary Dependent Blockchain

Disintermediation and peer-to-peer transaction are somewhere on the top list of blockchain-idealists’ mantras. And these two terms used to appear synonymous to me. At least, the equation, “disintermediation = peer-to-peer system,” was ingrained into my first impression.

However, one day I encountered one article that challenged my impression. Ever since, I have been sceptical about my first impression. Here is the article: “The new intermediaries at work behind the blockchain” (Esposito, 2017)

This article introduces realistic insights about blockchain by two specialists: Primavera de Filippi, a Research Fellow at Harvard University; Amira B. Soulami, a strategic analyst at L’Atelier BNP Paribas.

Amira B. Soulami repudiates the notion of total disintermediation, characterising blockchain’s eco-system as “decentralised intermediation”:

However, one day I encountered one article that challenged my impression. Ever since, I have been sceptical about my first impression. Here is the article: “The new intermediaries at work behind the blockchain” (Esposito, 2017)

This article introduces realistic insights about blockchain by two specialists: Primavera de Filippi, a Research Fellow at Harvard University; Amira B. Soulami, a strategic analyst at L’Atelier BNP Paribas.

Amira B. Soulami repudiates the notion of total disintermediation, characterising blockchain’s eco-system as “decentralised intermediation”:

“While this technology [blockchain] undoubtedly has the potential to shift the boundaries, creating trust between strangers without any central authority is not the same thing as having no intermediaries. (…) The blockchain is essentially providing a new way for people to trade, based on decentralised intermediation.”

“intermediation as we know it today is under threat, but the idea of pure peer-to-peer transactions is just a fantasy.”

(Esposito, 2017)

Now, as I wrote in the previous blog [LINK], Nakamoto contemplates peer-to-peer system without any trusted third party. The integrity of the peer-to-peer system is CONDITIONAL on the perfect absence of any third party: “[T]he main benefits [of digital signatures] are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.” (Nakamoto, N.D., p. 1) In other words, if there is an involvement of the third party, the integrity of its security is compromised.

Then, a natural question arises: does Soulami’s view of “decentralised (distributed) intermediation” confront Satoshi Nakamoto’s conditional security 1, no third party condition. Or, did Nakamoto simply miss Soulami’s point in his plan and found a temple for the never-ending pursuit for an unattainable dream. Or, with more twists, was it a part of his plan to deceive us: to build up his Distributed Kingdoms of Intermediaries?

Then, a natural question arises: does Soulami’s view of “decentralised (distributed) intermediation” confront Satoshi Nakamoto’s conditional security 1, no third party condition. Or, did Nakamoto simply miss Soulami’s point in his plan and found a temple for the never-ending pursuit for an unattainable dream. Or, with more twists, was it a part of his plan to deceive us: to build up his Distributed Kingdoms of Intermediaries?

Primavera de Filippi puts the question in a simple perspective:

“the problem with blockchain is not about trusting the math, but trusting the people who are working on the technology. (…) the system is not yet self-governing and that there are real human beings concealed behind the lines of code.”

(Esposito, 2017)

In reality, programmers are hiding behind the cornerstone of public blockchain, its trust-building consensus protocols. Neither consensus algorithm nor smart contract exist by itself; it is coded/programmed by human beings, who serve as intermediaries. This simple fact is frequently understated, or even neglected. And trust depends on the human factor behind consensus algorithms. In brief, blockchain is another intermediary-dependent system; and it only moves the trust-building mechanism from traditional intermediaries to new ones. (Esposito, 2017)

Oriane Esposito (2017) sums up the blockchain paradox, portraying it as a “full-circle loop” chain of human control.

Oriane Esposito (2017) sums up the blockchain paradox, portraying it as a “full-circle loop” chain of human control.

[T]he original philosophy of the blockchain technology is the libertarian ideal. It arose from the need to do away with human control and replace it with autonomous, self-regulating infrastructure. However, what is actually happening with the blockchain is that trust is being shifted from certain groups of human go-betweens to algorithms, behind which stand other human beings. One might say that the chain is really a loop and that basically we have come full-circle. This seems far from the original ideal.

Then, who are the new breed of intermediaries?:

What happened to the fundamentalistic goal of “disintermediation”? With these unexpected intermediaries, I felt defeated. I felt as if I were a vegan and just found out that the vegan soup that I ordered had beef stock in it.

Nevertheless, when we extend the time horizon towards the future, the situation might be different. There might be a hope in the long-run in the future. If these asymmetries vanish and entry barriers diminish, as technology advances, users might not need to depend on intermediaries any more. If this happens, theoretically, Nakamoto’s paradigm of pure peer-to-peer system could emerge. Time will tell.

The next blog contemplate “Autonomous Self-Regulating Governance” Myth-Conceptions.

Michio Suginoo

- platform architects and software developers: e.g. Bitcoin Core, Ethereum Foundation;

- those in validation: programmers (miners);

- platform as a service (PAAS) providers; e.g. Ethereum, Stratumn,

- exchange(s) and wallet(s): tech firms, e.g. Coinbase.

What happened to the fundamentalistic goal of “disintermediation”? With these unexpected intermediaries, I felt defeated. I felt as if I were a vegan and just found out that the vegan soup that I ordered had beef stock in it.

Nevertheless, when we extend the time horizon towards the future, the situation might be different. There might be a hope in the long-run in the future. If these asymmetries vanish and entry barriers diminish, as technology advances, users might not need to depend on intermediaries any more. If this happens, theoretically, Nakamoto’s paradigm of pure peer-to-peer system could emerge. Time will tell.

The next blog contemplate “Autonomous Self-Regulating Governance” Myth-Conceptions.

Michio Suginoo

Appendix

Here is the abstract of the paper, “Bitcoin: A Peer-to-Peer Electronic Cash System.” (N.D.):

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they'll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

(Nakamoto, N.D., p. 1)

Reference

- BTC.com. (ND). Pool Distribution. Retrieved from BTC.com: https://btc.com/stats/pool

- Digiconomist. (2014, 6 16). A 51% attack: the sum of all fears? Retrieved from Digiconomist.net: https://digiconomist.net/51_attack_sum_of_all_fears/

- Digiconomist. (2014, 7 7). Understanding Economies of Scale. Retrieved from Digiconomist: https://digiconomist.net/understanding_economies_of_scale/

- Digiconomist. (2016, 2 26). How Limited Block Size May Centralize The Use Of Bitcoin. Retrieved from Digiconomist: https://digiconomist.net/how-limited-block-size-may-centralize-the-use-of-bitcoin

- Digiconomist. (2017, 4 17). Bitcoin Electricity Consumption: An Economic Approach. Retrieved from Digiconomist.net: https://digiconomist.net/bitcoin-electricity-consumption

- Esposito, O. (2017, 5 24). The new intermediaries at work behind the blockchain. Retrieved 1 18, 2018, from L'Atelier BNP Paribas: https://atelier.bnpparibas/en/fintech/article/intermediaries-work-blockchain

- Greenspan, G. (2016, 4 12). Beware impossible smart contract. Retrieved from multichain.com: https://www.multichain.com/blog/2016/04/beware-impossible-smart-contract/

- Kasireddy, P. (2017, 12 11). Fundamental challenges with public blockchains. Retrieved from Medium: https://medium.com/@preethikasireddy/fundamental-challenges-with-public-blockchains-253c800e9428

- MaasTijs. (2017, 11 9). Yes, this kid really just deleted $300 MILLION by messing around with Ethereum’s smart contracts. Retrieved from: Hackernoon: https://hackernoon.com/yes-this-kid-really-just-deleted-150-million-dollar-by-messing-around-with-ethereums-smart-2d6bb6750bb9

- Nakamoto, S. (N.D.). Bitcoin: A Peer-to-Peer Electronic Cash System. NA: www.bitcom.org. Retrieved 1 31, 2018, from http://www.bitcoingroup.com.au/satoshi-whitepaper/