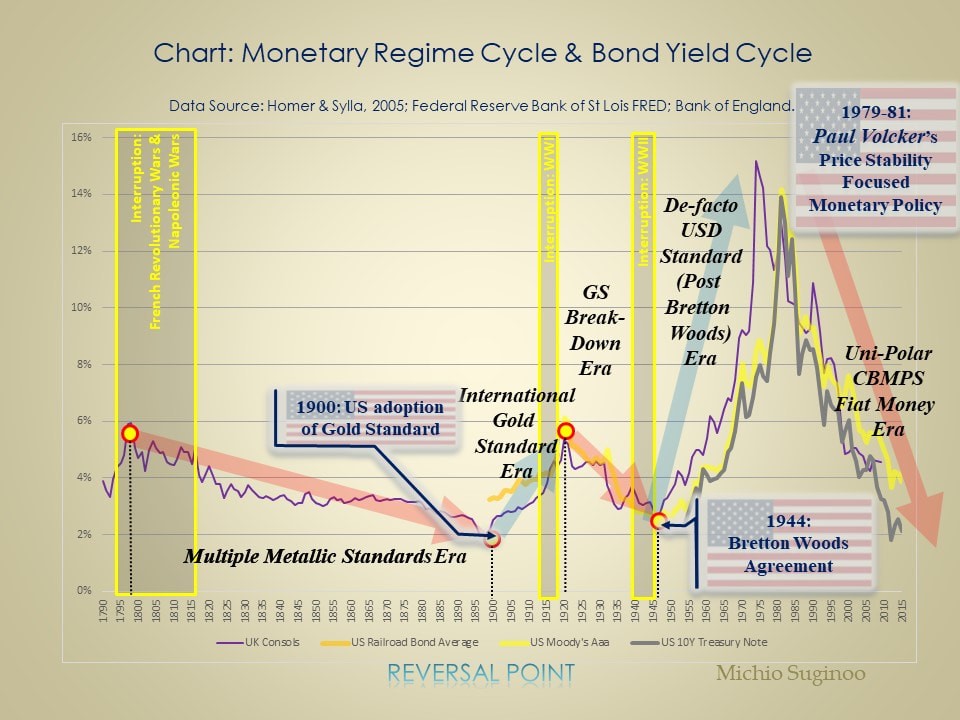

The Bond Wave Mapping

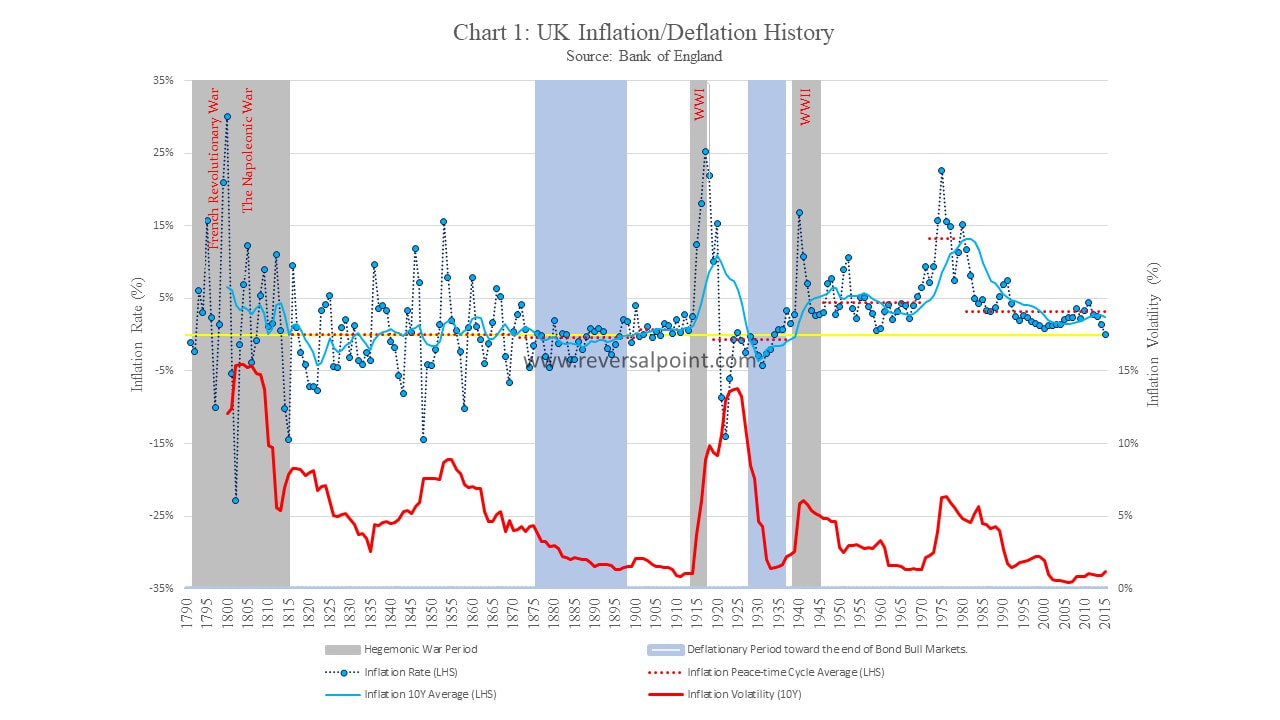

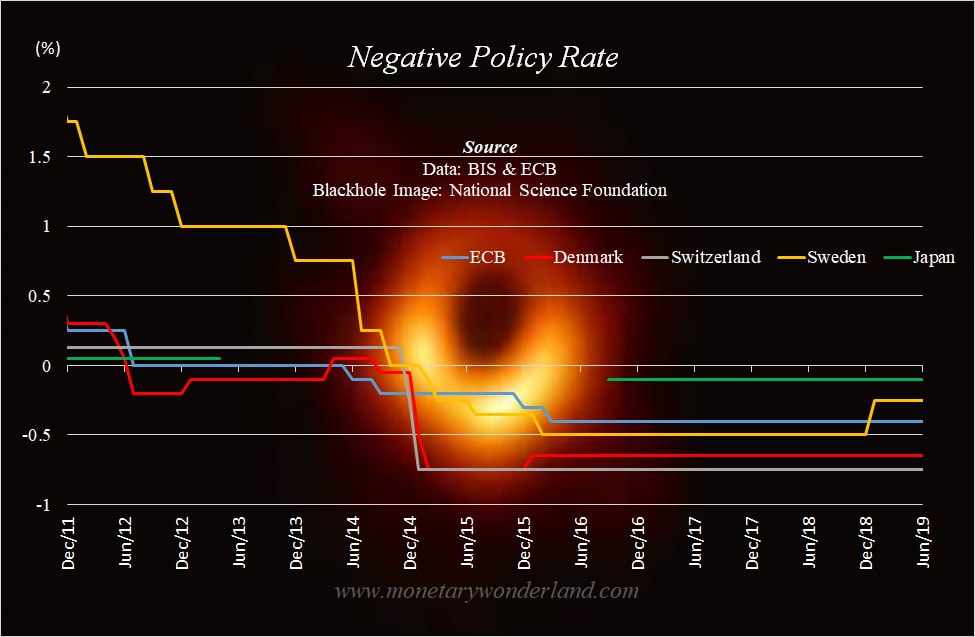

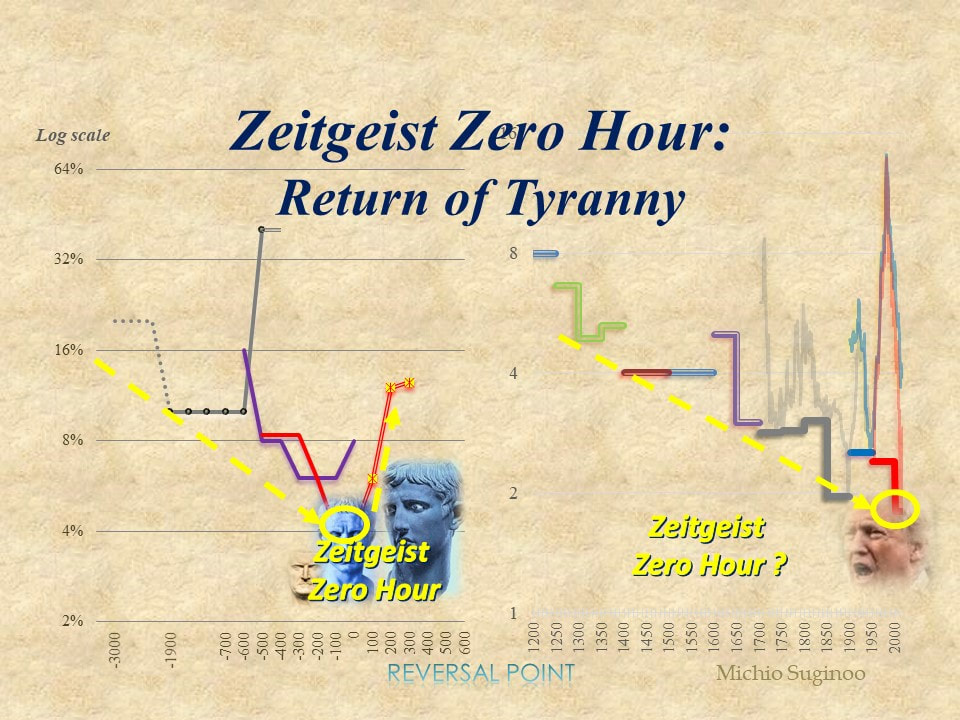

To capture recurrences and evolutions in the secular rhythm of the bond wave, I devised a simple technique called “bond wave mapping.” This technique captures the interactions of secular rhythms between the bond wave and other metrics. This simple method—primarily using crude data—enables us to extract hidden information about the bond wave as historical facts, loosening the confines of economic doctrines.

In brief, the bond wave is a manifestation of socio-economic and political realities. Bond wave mapping provides a heuristic way to apply historical analogy to make inferences about our present and future based on our past. The following contents are sample exercises showing the use of bond wave mapping to extract the hidden implications of this complex secular rhythm.

Michio Suginoo, CFA® (Chartered Financial Analyst)

Founder of www.reversalpoint.com Owner of www.monetarywonderland.com This website is operated independently by Michio Suginoo. Your contibutions to support this web site are welcome. For your contributions, please visit "Your Support."

Copyright © 2015-2019 by Michio Suginoo. All rights reserved.

| |